Van hypotheken naar tarwe – deel 2

Een beschrijving van de termijnmarkt voor tarwe en de rol van beleggers daarin.

Een beschrijving van de termijnmarkt voor tarwe en de rol van beleggers daarin.

Dit artikel is alleen in het Engels beschikbaar.

In part 1 of this series we introduced a basic Responsible Investing framework. Responsible investing, in our view, is all about making conscious choices in every step of the investment process, taking into account:

What would this imply for investing in wheat?

The role of wheat in society is quite straightforward – it’s a staple food. Wheat processed into bread, porridge, pancakes, pasta, noodles and other products feeds a large part of humanity. The cultivation of wheat and the settlement of human societies went hand in hand. And wheat is still the most widely grown crop in the world today. This reliance on wheat creates a vulnerability: the occasional wheat crop failure has been a recurring cause of hunger in various parts of the world for centuries. Just like in other areas of our economy, investors have an important role to play here. A role that requires awareness of the functioning of our wheat market and the investor’s place in it.

One cannot invest in wheat the way one can invest in gold: by storing it in a safe. Wheat may be classified as a non-perishable food, storing it requires care. And even when stored under ideal conditions, it will lose quality if stored for a long time. As such, storing wheat is a profession rather than an investment. But more important, while the value of gold is based on its characteristics that it lasts forever and cannot be produced, with wheat it’s the opposite: it has value because it can be consumed and massively produced. Just storing wheat doesn’t fill stomachs. In the longer run, the still growing demand for wheat has to be matched by a reliable production. Contributing to that production again is a profession rather than an investment. It requires labor, knowledge and craftsmanship. A well-functioning wheat market, however, also requires financial services such as loans, insurance and other types of risk transfer. Which requires participants who are able and willing to bear risk. This is where investors come into play.

By design, centrally cleared wheat futures contracts facilitate the transfer of price risk and price discovery.

One type of financial instrument that has proven its value for the food production chain for over 150 years are centrally cleared wheat futures contracts. By design, these instruments facilitate the transfer of price risk and price discovery. For these reasons, they are used by many participants in the food production chain. Measured against their long history, a rather new application of these instruments is to passively invest in wheat, mostly as part of a broader long-only commodity investment. In their search for diversification, inflation protection and return potential, many institutional investors have added such an investment to their portfolios. However, there is a growing concern whether this is an appropriate utilization of these futures contracts. RI/ESG considerations are cited by both supporters and opponents of such investments. Some investors go even further and have decided not to trade in agricultural futures markets at all, neither long nor short and neither passively nor actively.

As we explained in the first part of this series: we believe the fact that different investors have a different view in itself is a healthy sign. Surely when both sides can and do act upon their beliefs. And when investors are transparent about their considerations, they can add to the quality of the debate.

An important role of investors is to bear market risk. Advocates of (passive) long-only investing in commodity futures often argue that investors with long positions in wheat futures are bearing the price risk of farmers. In the offering documents of a publicly offered commodity fund we for instance read:

“The theoretical argument for a risk premium to holding long commodity futures goes back at least to John Maynard Keynes (1923). Commodity producers tend to have concentrated businesses, reliant on only one or two crops, metals, or other products. To mitigate their risk, they hedge by short-selling commodity futures, creating a premium for investors who go long commodity futures. Said differently, hedgers are willing to pay an insurance premium to stabilize future revenues, and this premium can be earned by commodity investors who are willing to bear price risk.”

This sounds like a rational argument that does not only explain the role of long-only investors in commodity futures, but at the same time the source of their returns. Fortunately, this source of returns can be verified by decomposing the price history of publicly traded commodity futures, such as on wheat. Essentially, three conceptually different price-time relationships govern the price formation of futures contracts, each linked to a different notion of time.

Typical for commodity futures is that futures contracts on the same underlying commodity for different delivery dates are traded in parallel. These contracts usually trade at different prices. Graph 1 shows the daily settlement prices of the Jul ’19, Sep ’19, Dec ’19, Mar ’20 and May ’20 contracts on Chicago soft red winter wheat, traded on CME during the first half of 2019. For instance, on 1 February the Jul ’19 contract settled at 532₡ per bushel, while the Dec ’19 contract settled at 552₡.

There are various explanations for the observed price differences. One of them is the so-called cost of carry. Since U.S. winter wheat is harvested in late spring, the Jul ’19 and Dec ’19 contracts essentially refer to the same wheat, which for the Dec ’19 contract has to be stored for five more months. This storage isn’t for free. A second reason: on 1 February this very same wheat still has to grow from plants which at that moment bear no grain. That early in the season, winter wheat plants look like grass waving in the wind; when they aren’t covered by snow, that is. The then most nearby wheat futures contract, for delivery Mar ’19, refers to the previous season’s crop, which is stored in farmer’s barns or in other warehouses.

The price-time relationship we are all most familiar with is the price fluctuation of the same commodity over time. The price tomorrow will typically be different from the price today, depending on the events that will happen between today and tomorrow – events that affect either supply or demand. This holds for the cash price of wheat, but also for wheat futures contracts. In Graph 1, the price of the Jul ’19 contract on 15 February was significantly below its price two weeks earlier, while it still referred to the very same – but not yet existing – wheat.

While between 1 and 15 February the Jul ’19 wheat contract may have remained the same contract, one thing did change: the remaining time-to-delivery decreased by 2 weeks. This affects the price as well. And this is where Keynes enters the story. He argued that if producers want to hedge their risk by short-selling commodity futures, speculators will have to be net buyers. But speculators will not go long unless they expect the futures price to rise. Essentially, the futures price has to trade below the expected spot price at delivery. The less the remaining time-to-delivery, the less the remaining price risk, the more the futures price should rise towards the expected spot price. On average, this will result in a rising futures price over time due to getting closer to delivery. This is the insurance premium described in the abovementioned commodity fund offering documents.

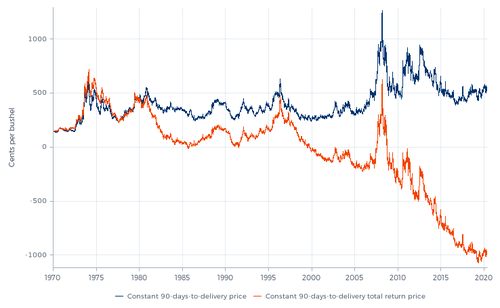

These three price-time relationships together explain the prices and returns of wheat futures. Every trading day new events impact supply and/or demand, while at the same time the remaining time-to-delivery decreases by one day. Let’s further analyze these different relationships. As a starting point we need to generate a price series representing constant time-to-delivery prices. In this price series, the diminishing-time-to-delivery effect on the price development is removed. We could do so by looking at cash prices, but we can also create for instance a constant 90-days-to-delivery price series by interpolating the prices of the two futures contracts with a time-to-delivery just shorter and just longer than 90 days. Graph 2 shows this price series, starting from January 1970.

During a period of 50 years it has risen more than 380%, representing a roughly 2.7% annual return. But bear in mind, these are constant time-to-delivery prices. The theoretical risk premium for holding a long position in wheat futures still has to be added. We can construct the applicable constant 90-days-to-delivery total return price series in a similar way by interpolating the 1-day price changes of the same two futures contracts used to construct the price series in Graph 2. If we accumulate these price changes, starting from the same price level in January 1970, we get the correct price development including the diminishing-time-to-delivery effect. This is shown by the orange curve in Graph 3. The extent to which this curve rises above the blue curve represents the risk premium.

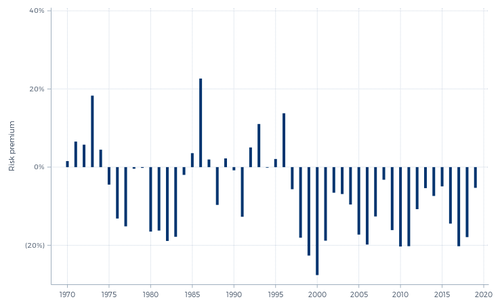

Opposite to the theory, there does not seem to be a positive risk premium, at least not during the past 50 years. In Graph 4 we show the diminishing-time-to-delivery premium (the difference between the changes of the two curves in Graph 3) for every calendar year. From 1997 onwards, this shows a negative risk premium for each year. During some years, holders of long positions in wheat futures were paying (!) even more than 20% of the underlying value.

Where does the theory go wrong? The crucial element is the assumption that commodity producers would mitigate their price risk by short-selling commodity futures. This argument isn’t very appealing for farmers – at least not early in the crop season. During the season, the biggest concerns for these farmers are the weather conditions. Drought or flooding may dramatically reduce the size of their crop. If farmers sell their crop in advance by short-selling futures contracts, they may not be able to make delivery on these contracts. When that happens, they will have to buy wheat from other farmers. And (some of) these farmers will probably have been hit by the same drought or flooding, meaning prices will be higher.

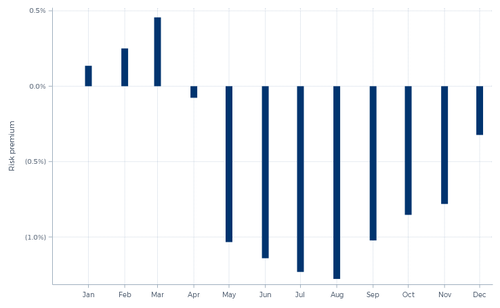

So, as long as farmers have not harvested their crop, short-selling futures does not mitigate their risk, but instead leverages it. In case of drought or flooding, farmers are better off by delaying their selling until they can sell their reduced harvest against the in such circumstances typically higher prices. This behavior of farmers is illustrated in Graph 5, which shows the risk premium per calendar month (averaged over the past 50 years). Only during the winter months, when the underlying wheat is safely stored away, long positions in wheat futures yield a positive risk premium.

To fully understand the role of wheat futures, we have to look at the other participants in the wheat market as well. In its classic form these participants are the baker (who bakes bread from flour) and the miller (who mills flour from wheat). Bakers do not like price fluctuations. They prefer to keep the price of their bread the same for as long as possible. This means that they must be certain that flour will be delivered at an agreed price over an extended period. It is therefore customary for the bakers to conclude a contract with a miller – for instance once a year – under which the miller agrees to deliver flour at a fixed price throughout the following year.

This flour must still be milled. And a large part of the wheat from which that flour will have to be milled has not even been harvested when the contracts are signed. For the millers this does not pose a problem. As soon as they conclude a contract with a baker, they buy wheat futures. This way, they fix their purchase and sales prices and quantities at the same time, such that they can concentrate entirely on what they are good at: milling wheat.

Who is willing to sell wheat futures when a miller wants to buy them? As we explained, that will not be the farmers yet. So, in this standard scenario, it’s not producers who want to hedge their risk, but food processors. And following Keynes’ argument: if food processors want to hedge their risk by buying commodity futures, speculators will have to be net sellers. Rational speculators will only be willing to do so if the futures price trades above the expected spot price at delivery. This way, they will receive a risk premium for holding a short futures position. This is the risk premium that is expressed – with a negative sign – in Graphs 4 and 5.

If food processors want to hedge their risk by buying commodity futures, speculators will have to be net sellers.

The phenomenon of returns on a long-only commodity investment that involves the rolling of futures contracts being substantially lower than one would expect from looking at the price levels of nearby futures is well-known. In literature, this is often attributed to the rolling costs. We regard that as a somewhat misleading term, especially when used to give the impression these costs can be avoided by applying a smart rolling strategy. As we illustrated above, in the case of wheat these costs constitute the premium that holders of long positions in wheat futures typically ‘pay’ every day the contracts get closer to delivery. No rolling strategy can circumvent this effect, however smart they might be. The real rolling costs, the commissions that have to be paid and the market impact of the rolling activity, come on top of this risk premium.

So, the more natural position for investors in wheat futures is at the short side. What happens when investors nonetheless choose to apply a passive long-only strategy? The direct impact: they will simply pay a risk premium instead of collecting it. But there is another impact as well. When more and more investors act like this, their market impact will become visible. When investors repeatedly buy contracts ahead of delivery to sell them just before delivery, this will result in futures prices trading even higher above the expected spot price at delivery. Which means the risk premium to be paid for holding long futures positions will increase.

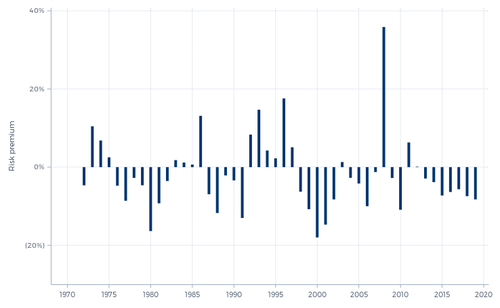

From this point of view, we don’t think it’s a coincidence that the popularity of passive long-only investing in commodity futures in the past decades has been accompanied by more significant risk premiums as shown in Graph 4. And there is another indication of this impact. Chicago soft red winter wheat is the wheat with the highest weighting in the most popular commodity indices. Much less popular among long-only investors in commodity futures is the contract on Minneapolis hard red spring wheat. Graph 6 shows the risk premium for this futures contract since 1970. This risk premium has hardly increased in the past decades.

When futures prices trade higher above their expected spot price at delivery, this has two important consequences. First of all, the negative returns on passive long-only investments in wheat futures increase. But more important, hedging becomes more expensive for the wheat processors. The millers will pass on these extra costs to the bakers, resulting in higher prices for wheat products for the end consumers, while farmers will not get a higher price for their wheat. It could also motivate millers to no longer hedge their future wheat demand, but instead add a risk premium to their flour price, which has the same effect on the end users of wheat.

It may often seem hard to prove that responsible investing will benefit investors, but it is clear that irresponsible investing will dramatically hurt most investors.

This again illustrates something we noted in the first part of this series: It may often seem hard to prove that responsible investing will benefit investors, but it is clear that irresponsible investing will dramatically hurt most investors. Paying a 20% risk premium may seem like the perfect corrective measure, but we fear that many investors implicitly paying this premium are not fully aware of this; these losses will often be hidden within broader commodity investments.

It will not come as a surprise that we are no advocates of passive long-only investing in wheat futures, given the role of these futures and the role of speculative investors in this market. However, this doesn’t mean that investors should stay away from this market, nor that they should limit themselves to only taking short positions. Keynes one more time: Rational investors are short futures when they are priced above the expected price at delivery, but long when they are priced below the expected price at delivery. Responsible investors position themselves the same way.

So far, we’ve only really discussed one important function of markets: the transfer of risk. But markets also serve another function: they facilitate price discovery. This is especially true for futures markets. For markets to function, there should be a continuous interaction between prices, supply and demand. For instance, when shortage looms, prices should rise in time to give producers incentive to raise their production and/or to give consumers an incentive to find alternatives. Even though most farmers will not be active in trading wheat futures early in the crop season, they follow the futures price development closely. It guides them in their decision making: whether or not to overseed a poorly germinated crop, how much to invest in irrigation, et cetera. Investors contribute to this price discovery process by buying when they believe that the actual futures prices underestimate the probability of future shortage. Such buying can stimulate farmers to produce enough for all of us.

This rather long story is mostly about investing in wheat futures. But we believe much of it can also be applied to other commodity futures. Overall, the whole concept of passive investment strategies that are based on trading futures contracts is quite a contradiction that can have harmful consequences, as we hope to have demonstrated. Futures by definition have a limited lifespan. To have longer running positions in them requires regular trading activity. And trading activity inevitably has market impact. In itself, there is nothing wrong with market impact. In fact, market impact is the only force that drives markets. But this force should be used with respect. By aware market participants who take responsibility for their actions.